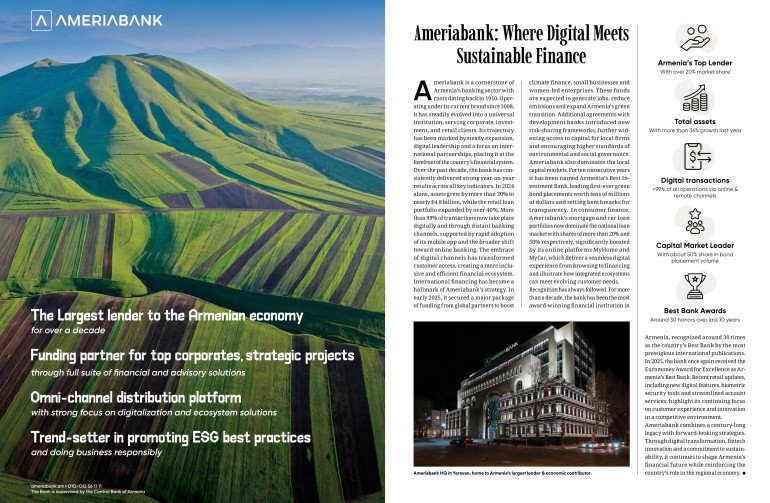

A leading financial institution in Armenia continues to set the pace for economic development, combining a rich historical legacy with modern innovation. With origins dating back more than a century, the bank has transformed into a comprehensive service provider for corporate, retail, and investment clients.

Recent performance highlights the institution’s expanding influence. In the past year, total assets surged by over 30%, nearing $4.8 billion, while lending to individuals grew by more than 40%. A key driver of this expansion has been the rapid adoption of digital services—more than 99% of all transactions are now processed through remote and mobile channels, making banking more accessible and efficient for customers.

International partnerships have also played a crucial role in the bank’s strategy. Early this year, it secured substantial funding from global development organizations to support climate-friendly projects, small businesses, and women entrepreneurs. These initiatives are expected to create new jobs, lower carbon emissions, and advance the country’s transition to a green economy.

In capital markets, the institution has maintained a dominant position, recognized for ten consecutive years as the nation’s top investment bank. It has pioneered the issuance of green bonds and set new standards for transparency. On the retail side, its mortgage and auto lending platforms now command more than 20% and 50% of the national market, respectively. Fully digital services—from application to approval—have made these products highly popular.

Award committees have repeatedly acknowledged the bank’s performance. It has earned the title of Armenia’s best bank around 30 times from prestigious international financial publications, and in 2025, it once again received a top banking award. Recent upgrades to its digital platforms, including biometric security and streamlined account management, reflect its ongoing commitment to customer-centric innovation.

By blending a long-standing heritage with forward-looking strategies in sustainability and financial technology, the bank continues to play a central role in shaping Armenia’s economic landscape and enhancing its standing in the region.